The FC4S Assessment Programme

The FC4S Assessment Programme, to whose development PwC has contributed since 2018, is the first initiative of its kind to evaluate the state of sustainable finance in the key financial centers of the globe.

- The "Institutional foundations" pillar explores the key institutions and objectives that drive the growth of sustainable finance in financial centres.

- The "Enabling Environment" pillar outlines the structures that facilitate the expansion of sustainable finance through the provision of rules and incentives and the development of capabilities.

- The "Market Infrastructure" pillar examines how market participant capital mobilisation is stimulated by commitments, strategies, and incentives.

The FC4S Assessment Programme provides an unprecedented global baseline of the sustainability and contribution of the world's leading financial centres to the UN Sustainable Development Goals.

The analysis of global Assessment results enables UNDP FC4S to:

- Continue to develop value-adding products and services for each member while considering regional and international priorities.

- Promote consistent regional objectives and specialized cross-regional activity by connecting members based on their needs.

- Collaborating with global alliances and policy forums, such as the G7, G20, and UNFCCC Conference of the Parties, to lead on identifying and integrating important matters and advancing research.

In 2021, FC4S began providing participants personalized reports that included strategic recommendations based on their results and benchmark performances.

2021 EDITION

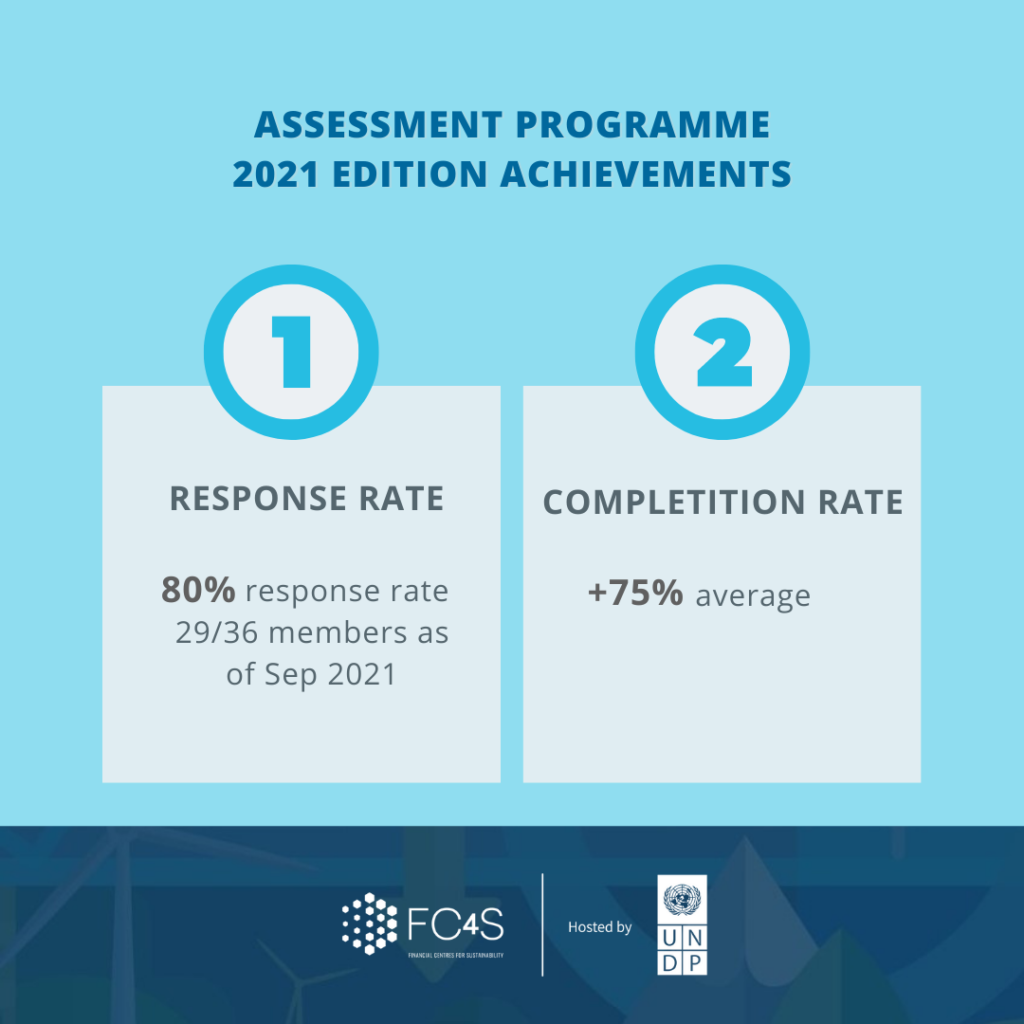

2021 Edition Performance and Achievements

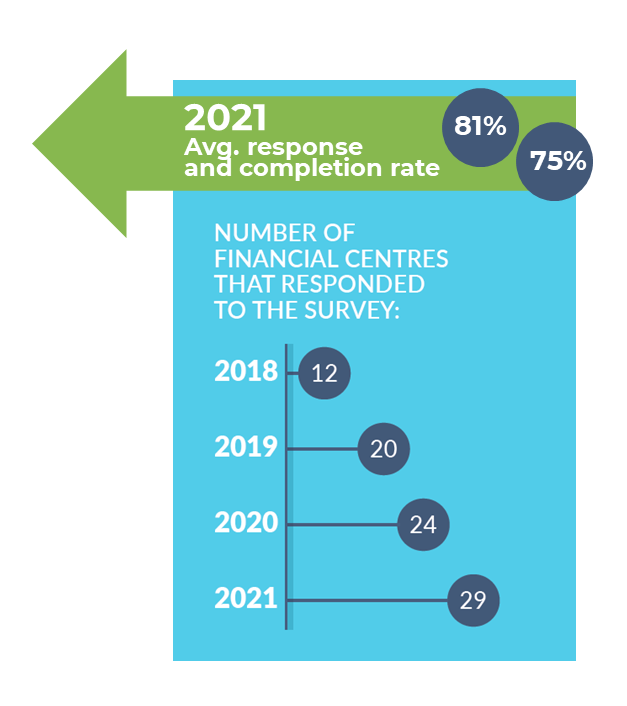

The strong bilateral and regional engagement through the questionnaire development and completion period enabled high participation levels in the survey:

- Response rate: Growing from 12 respondents in 2018 to 20 in 2019, 24 in 2020, and 29 in 2021. This participation follows FC4S increasing membership.

- Completion rate: +75% of the questions in the survey, on average.

- Respondent: 4 regional clusters.

- Policies and regulations sampling: Covered + 255 policies globally.

- Firms sampling: Surveyed + 270 market players

- Methodological Handbook: For the first time a methodological handbook was developed to provide instructions and key definitions to promote consistency in the questionnaire.

FC4S STATE OF PLAY 2021

This year’s assessment reveals seven key insights on how financial centres across all continents are mobilizing their capital, resources, connectivity, and expertise to support the low-carbon transition and the achievement of the Sustainable Development Goals (SDGs).

PREVIOUS EDITIONS

Shifting Gears I

This report, published by the Financial Centres for Sustainability (FC4S) Network, measures for the first time the contribution of financial centres to sustainable development and the ongoing low-carbon transition. It also identifies key challenges facing this growing sector.

In 2018, supported by EU EIT Climate-KIC the FC4S Network established an Assessment Programme to track the progress of financial centre efforts to support the expansion of green and sustainable finance markets, and explore different ways of measuring the contribution of financial centres to sustainable development and the low-carbon transition.

Shifting Gears II

The FC4S Shifting Gear II report which is based on its third Annual Assessment Program, developed in partnership with PwC, an FC4S partner and co-funded by EIT Climate-KIC, was launched during the annual Abu Dhabi Sustainable Finance Forum 2021, hosted by Abu Dhabi Global Market (ADGM)

FC4S Member Testimonials

Some of our members have highlighted the impact of the FC4S Assessment Programme Personalised Reports on their Financial Centre.

Watch Below Testimonials from Mexico, Casablanca, Liechtenstein, Lagos and Jersey regarding their participation in 2021.