The UNDP FC4S Network

Assessment Programme

The UNDP FC4S Network

Assessment Programme

The FC4S Assessment Programme (AP) is the first initiative of its kind to evaluate the state of sustainable finance in key international financial centres. It gathers information covering both private and public sector actions and instruments to advance sustainable finance, and also considers their contribution towards the UN Sustainable Development Goals.

The Assessment Programme aims to evaluate the state of green and sustainable finance across the world’s leading financial centres and track the progress of their efforts to support sustainable finance markets.

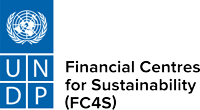

The Assessment Programme pillars:

The FC4S Assessment Programme is based on three pillars:

- The "Institutional foundations" pillar explores the key institutions and objectives that drive the growth of sustainable finance in financial centres.

- The "Enabling Environment" pillar outlines the structures that facilitate the expansion of sustainable finance through the provision of rules and incentives and the development of capabilities.

- The "Market Infrastructure" pillar examines how market participant capital mobilisation is stimulated by commitments, strategies, and incentives.

It explores institution and objective driving the growth of sustainable finance.

It outlines structures that facilitate the expansion of sustainable finance.

It examines how capital mobilisation of markets participants is stimulated by commitments, strategies, and incentives.

It maps global, regionaland local trends and opportunities and considers international best-practices to expand sustainable finance.

Why Participate?

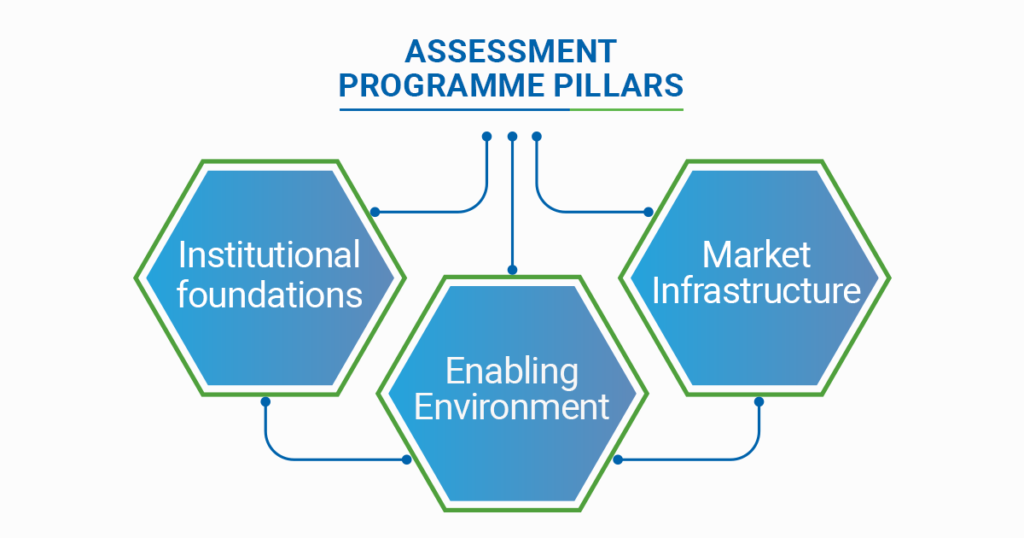

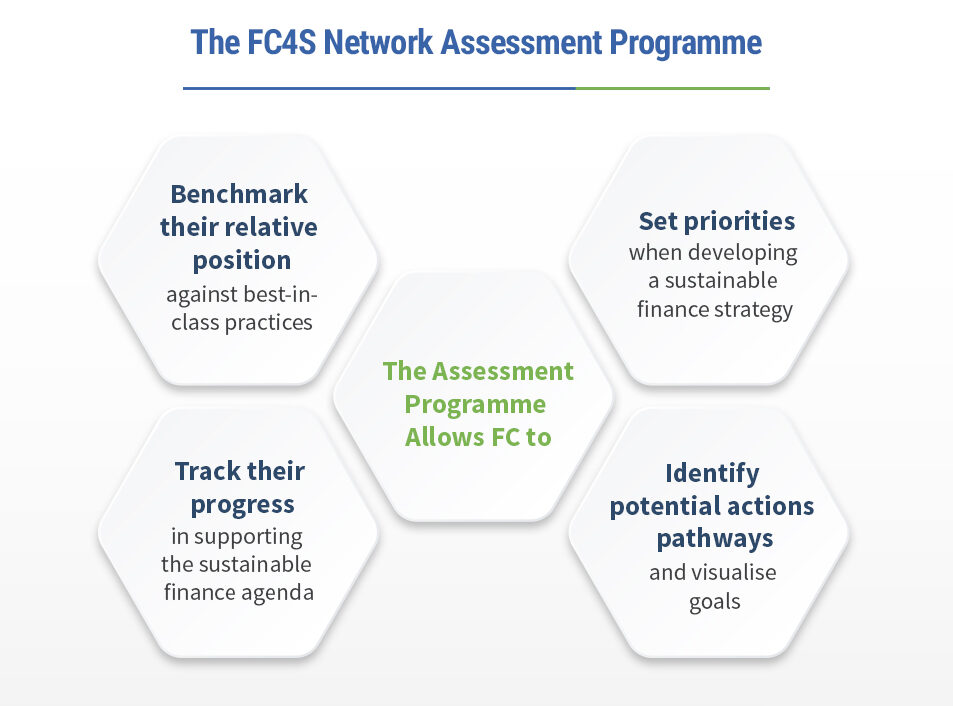

The Assessment Programme allows members to:

- Benchmark against peers and discover competitive advantages.

- Make informed strategies and action plans, by providing a robust baseline for them.

- Inspire policymakers and local market actors on possible next steps for boosting the development of sustainable finance.

- Track members' local progresses in supporting the sustainable finance agenda.

- Attract potential investors who value transparency and accountability.

- Position themselves as leaders by demonstrating commitment towards learning and improving.

The Assessment Programme analysis

Analysis of the global Assessment Programme’s results enables UNDP FC4S to:

Promote consistent regional objectives andspecialized cross-regional activities by connecting members based on their needs.

Inform policy, through international

cooperation.

Develop value-adding products

and services

Collaborate with global alliances and policy forums to identify and integrate important agenda matters and advance research where necessary.

Our Success Stories

Since 2021, FC4S has been providing participants with personalised reports that included strategic recommendations based on their results and benchmark performances. Take a look at some public editions of the personalised reports.

Institut de la finance durable (IFD), Paris

2021 Personalised Report

Consejo Consultivo de Finanzas Verdes (CCFV), México

2022 Personalised Report

Laboratório de Inovaçao Financeira, Rio de Janeiro, Brazil

2022 Personalised Report

Jersey Finance

2022 Personalised Report

The Assessment Programme 2023–24

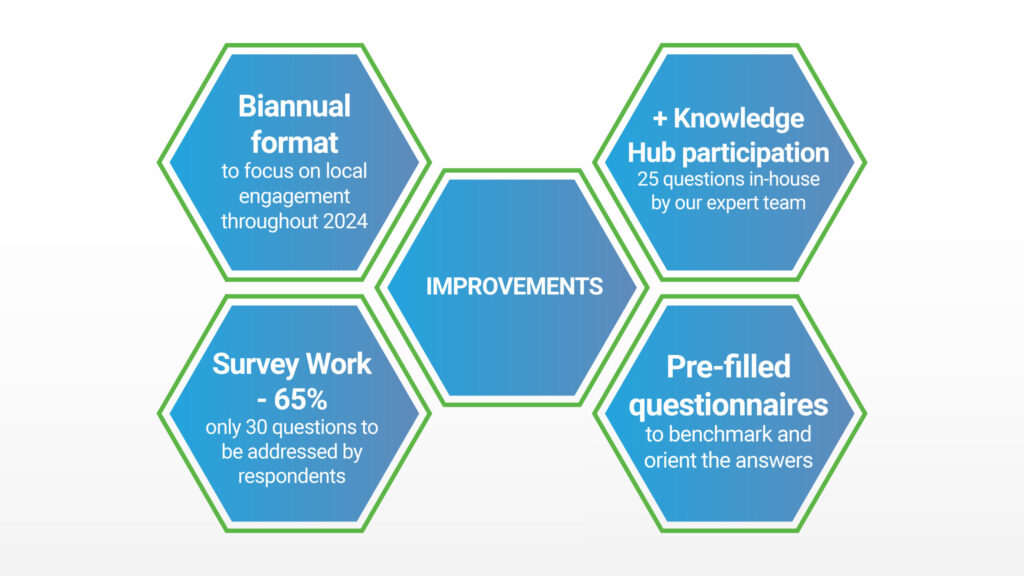

Shifting to a biannual nature in this latest edition to support members’ local progress more strongly, the Assessment Programme 2023 is focused on data collection, survey implementation and the delivery of Global and Personalised reports. Whereas, Assessment Programme 2024 will focus on supporting members to advance sustainable finance through the gaps Assessment Programme has identified (including by implementing wider UNDP Sustainable Finance Hub (SFH) tools).

How is the Assessment Programme 23-24 different?

Previous Editions

FC4S State of Play 2021

The 2021 assessment revealed seven key insights on how financial centres across all continents mobilised their capital, resources, connectivity, and expertise to support the low-carbon transition and the achievement of the Sustainable Development Goals (SDGs).

Shifting Gears II

The FC4S Shifting Gear II report which is based on its third Annual Assessment Program, developed in partnership with PwC, an FC4S partner and co-funded by EIT Climate-KIC, was launched during the annual Abu Dhabi Sustainable Finance Forum 2021, hosted by Abu Dhabi Global Market (ADGM).

Shifting Gears I

This report, published by the Financial Centres for Sustainability (FC4S) Network, measures for the first time the contribution of financial centres to sustainable development and the ongoing low-carbon transition. It also identifies key challenges facing this growing sector. In 2018, supported by EU EIT Climate-KIC the FC4S Network established an Assessment Programme to track the progress of financial centre efforts to support the expansion of green and sustainable finance markets, and explore different ways of measuring the contribution of financial centres to sustainable development and the low-carbon transition.